- Financial Deficit Reaching $40 Billion and Counting, an Unprecedented Figure in the Entity’s History by September

- Thousands of Companies Depart and Investment Worth Tens of Billions Decline, Escalation Since the “Yafa Operation”

- Hebrew Reports Confirm Capital Flight Fears Due to Yemeni Threats Following Al-Hodeidah Strike

- Stock Market Decline and Significant Contraction in Oil, Shipping, and Trade Sectors

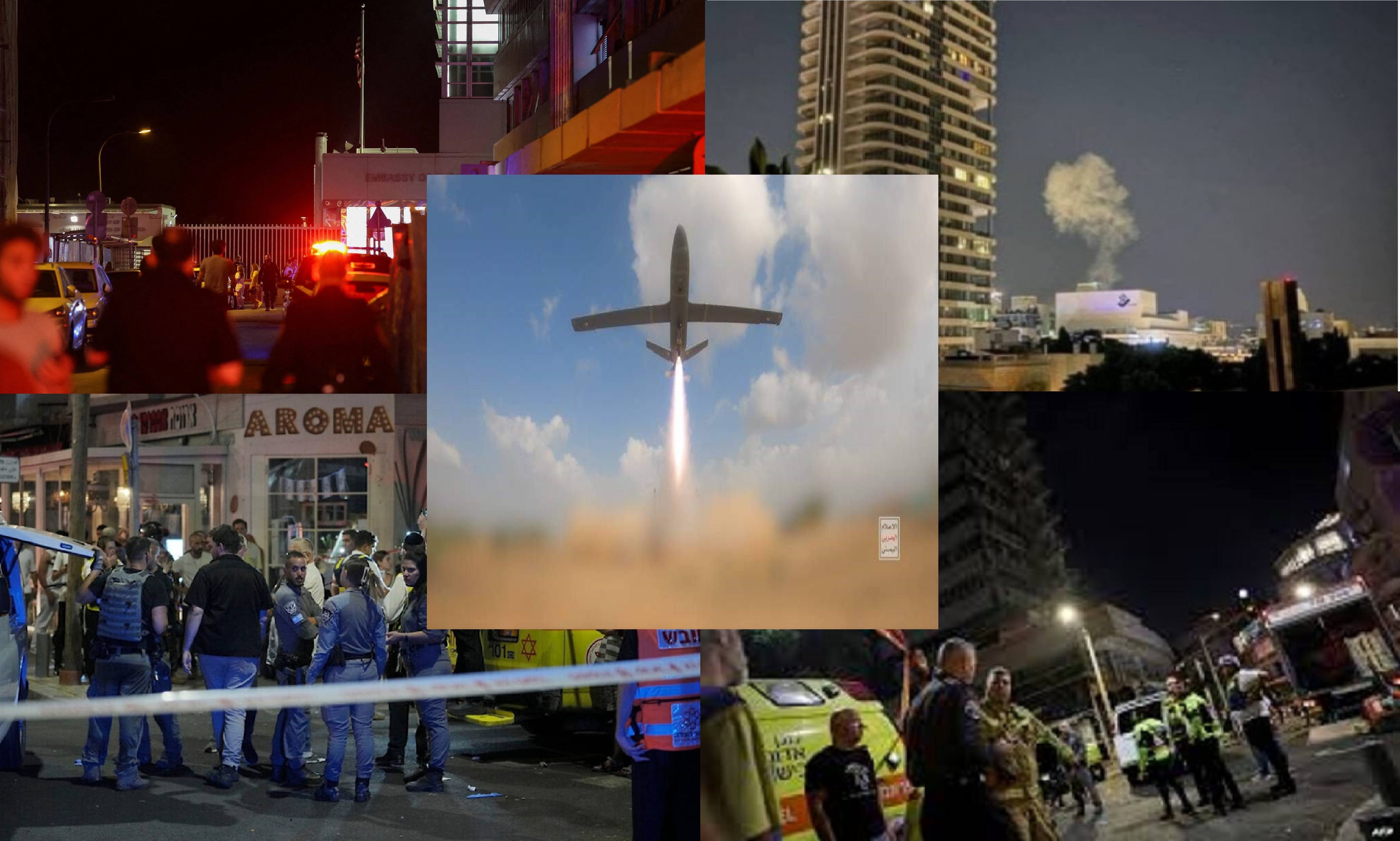

The economic losses within the Zionist enemy continue to mount amidst ongoing Yemeni operations in the Red Sea, Arabian Sea, Mediterranean Sea, and Indian Ocean. Additionally, Yemeni threats to bombard occupied Palestinian territories have created substantial apprehension among investors and prompted numerous companies to withdraw from various sectors, fearing potential Yemeni strikes that could severely impact the Zionist economy in an unprecedented manner.

Zionist media has highlighted a new aspect of the Israeli economic collapse due to ongoing Yemeni operations and threats to bomb Tel Aviv and other vital targets within the occupation's depth. The Yemeni armed forces have promised such attacks if the Zionist aggression and blockade on the Palestinian people in Gaza continue.

Multiple economic reports from international and Hebrew media have shed light on the changes imposed by the Yemeni armed forces, confirming that Yemen has created a new adverse reality threatening the Israeli economic sectors since the blessed Yafa Operation. The ensuing Zionist arrogance, which poured its wrath on the port of Al-Hodeidah, prompted the Yemeni armed forces to contemplate a powerful and devastating response. The potential consequences were apparent even before execution, leading to the withdrawal of many Zionist companies.

Investments Fleeing Due to Yemeni Threats:

The Hebrew economic newspaper "Globes" reported that investors continue to withdraw their funds from "Israel" amidst fears of economic instability due to the ongoing war on Gaza and concurrent Yemeni escalation. The Yemeni armed forces have threatened to bomb vital targets within the occupied Palestinian territories, particularly in light of the recent blessed Yafa Operation. This makes any future Yemeni operations in the occupied Palestinian depth akin to a hammer that will demolish what remains of the Zionist economy.

In its analysis, the Hebrew newspaper indicated that the flight of both domestic and foreign funds from "Israel" continues to rise. Just three days ago, capital movements to external investments jumped from $2.2 billion in the third quarter of 2023 to $2.9 billion in the fourth quarter of the same year, and to $3.6 billion in the first quarter of 2024. The "Calcalist" newspaper noted that in the first four months of 2024, a total of 26.4 billion shekels left "Israel" due to increased exposure of public pension funds and savings funds to foreign assets such as stocks, bonds, and non-tradable assets, driven by investors' fears of the ongoing war, prompting them to flee abroad.

Hebrew reports have highlighted financial losses following the Yafa Operation. Sources in the Israeli tax authority stated that damages from the incident amount to several million shekels. More than 250 property tax claims were filed due to the massive damage to Jewish settlers' homes.

The reports also confirmed the withdrawal of many small and medium-sized companies from investing within the occupied Palestinian territories, alongside the intention of thousands of major companies to cease their activities within the occupied Palestinian territories in anticipation of Yemeni escalation. Everyone now understands the meaning of the Yemeni armed forces' threats, which promised a significant and impactful response.

Comprehensive Zionist Economic Bleeding:

In a report by Al-Jazeera, Qatari expert on Israeli affairs Ahmad al-Bahansi stated that "the economic sectors affected by this confrontation are numerous," but he particularly mentioned the ports, especially the port of Eilat, whose administration indicates its bankruptcy. Al-Bahansi emphasized the economic importance of this port as it is the only gateway for the Zionist entity to the Red Sea.

In the same context, the startup sector is experiencing a sharp contraction due to Yemeni escalation. This sector, considered the second most significant that will suffer from the expanded confrontations, has seen 44% of startups leave "Israel." Al-Bahansi added, "We are not exaggerating when we say that the startup sector represents the backbone of the Israeli economy after the facilities provided by 'Israel' over the past decades to attract many European, American, and even Asian startups." The withdrawal of these companies from operating within the occupied Palestinian territories will double the severe economic blows to the Zionist entity.

The stock market sector has seen multiple reports indicating a decline in the TA-125 index in the Tel Aviv Stock Exchange and the TA-35 index for major companies following the Zionist aggression on Al-Hodeidah last Saturday by 1.1%. The TA-Construction index dropped by 1.6%, while the TA-Biomed index fell by 2%. The Zionist aggression on Al-Hodeidah and the accompanying Yemeni military threats of a severe and devastating response had significant repercussions on the Zionist economy. Implementing Yemeni threats would be the final blow to the Zionist economy's backbone, comprising startups and small and medium-sized enterprises.

Observers affirm that other economic sectors such as tourism and construction could also be affected by Yemeni operations.

Regarding the oil and shipping sectors, Al-Bahansi stated, "The continued Yemeni operations on ships passing through the Red Sea to Palestinian ports mean ongoing tensions, potentially leading to higher oil prices beyond current levels, and increased insurance costs for ships, which have already multiplied since November."

Similarly, Reuters reported earlier this month from unnamed insurance sector sources that "war risk premiums, paid when ships sail through the Red Sea, reached 0.7% of the ship's value in recent days, up from about 1% earlier this year, causing additional costs of hundreds of thousands of dollars." The premiums for war risk insurance on Chinese ships, which are perceived as having no ties to 'Israel' or the targeted United States, remained around 0.2% to 0.3%.

Financial Deficit Compounds the Entity’s Losses:

Reports from Reuters and Hebrew media indicate that the financial deficit in "Israel" widened last month to 7.6% of GDP over the past 12 months, equivalent to 146 billion shekels ($39.8 billion), up from 7.2% in May. The Zionist finance ministry’s accountant general Yali Rothenberg confirmed this information in July.

Rothenberg stated that the deficit exceeds the government’s set limit of 6.6% by more than 1%. He added that the financial deficit in the past month alone was 14.6 billion shekels ($4 billion), compared to 6.4 billion shekels ($1.74 billion) in June 2023.

Since the beginning of this year, the financial deficit reached 62.3 billion shekels ($17 billion), compared to a surplus of 6.6 billion shekels ($1.8 billion) in the first six months of 2023.

Consequently, Zionist government spending has exceeded 300 billion shekels since the beginning of the year, a 34.2% increase compared to the same period last year. Rothenberg added, "The main increase in the deficit is due to higher spending on defense and civil ministries because of the war. Even excluding war expenses, government spending rose by about 9.3%, compared to a 3.3% increase in state revenues, which reached around 238 billion shekels since the beginning of the year, compared to 230.4 billion shekels in the first half of 2023." The Zionist finance ministry expects the deficit to peak by September.

Amid this economic bleeding, which deepens the suffering of the Zionist entity, the upcoming Yemeni operations in response to the Zionist aggression on Al-Hodeidah are expected to accelerate the economic collapse and financial deficit beyond the anticipated levels by Zionist officials and experts.

Under this substantial economic and financial pressure, the impact and effectiveness of Yemeni operations are clear in raising the cost of Zionist crimes. This will inevitably put an end to the Zionist entity and its criminal backers, who only understand the language of force.